Secondly, we will be importing the coint_johansen function from the Johansen library, which is a function developed by James LeSage at the Department of Economics, University of Toledo. The first library to be imported is the Pandas library which will be used to read data from a CSV file and then to create a data frame containing data of the two instruments. We will start by importing two libraries. We can expect both of these assets to be correlated, we will now check whether these assets are cointegrated if so we could then create a pairs trading strategy on this pair which will prove to be profitable. Let us now implement the Johansen Test in Python on a pair of assets, here we have taken the GLD - GDX pair as an example, GLD is the SPDR Gold Trust ETF and GDX is the Gold Miners ETF. This is the essence of the Johansen Test. If the change in the value of the portfolio is related to its current value by a negative regression coefficient or in this case a negative eigenvalue, then we would have a mean reverting or stationary portfolio. The linear combination of these prices represents the net market value of the portfolio.

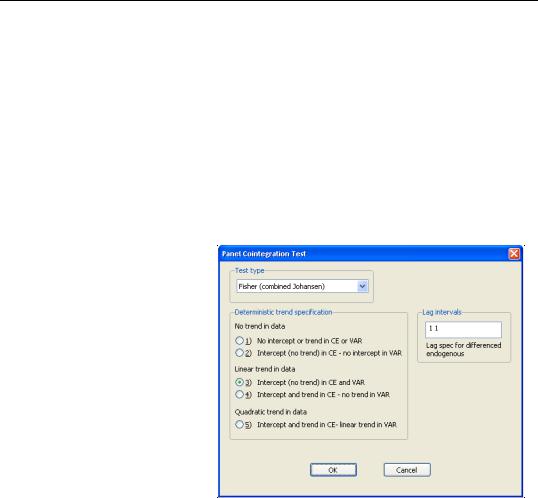

#JOHANSEN TEST EVIEWS 10 SERIES#

When all the eigenvalues are zero, that would mean that the series are not cointegrated, whereas when some of the eigenvalues contain negative values, it would imply that a linear combination of the time series can be created, which would result in stationarity. In the Johansen test, we check whether lambda has a zero eigenvalue. The coefficients for each of the lag terms in this equation are therefore vector terms. In this equation, we have multidimensional variables and hence the multiplication will be matrix multiplication. When there are more than one variables, you can still write the relationship of the current prices as a linear function of the past prices in an autoregressive model, but to be more precise this model is then called the Vector Error Correction Model (VECM). The ADF test is based on an autoregressive model, a value from a time series is regressed on previous values from the same time series.

The Johansen test is based on time series analysis. Let us now look at the mathematics behind the Johansen Test. This is overcome by using the Johansen Test because it is order independent. Secondly, the ADF test gives different results on changing the order of the two-time series. To learn more about these strategies enroll for the course Mean Reverting Strategies in Python by Dr. This implies that a stationary linear combination of assets can be created using more than two-time series, which could then be traded using mean-reverting strategies like Pairs Trading, Triplets Trading, Index Arbitrage and Long-Short Portfolio. The Johansen Test can be used to check for cointegration between a maximum of 12-time series. The ADF test enables one to test for cointegration between two-time series. ADF test has limitations which are overcome by using the Johansen test.

Another popular test for cointegration is the Augmented Dickey-Fuller (ADF) test.

#JOHANSEN TEST EVIEWS 10 HOW TO#

In this blog post, you will understand the essence of the Johansen Test for cointegration and learn how to implement it in Python.

0 kommentar(er)

0 kommentar(er)